The Planning Process

A systematic approach to building your financial future.

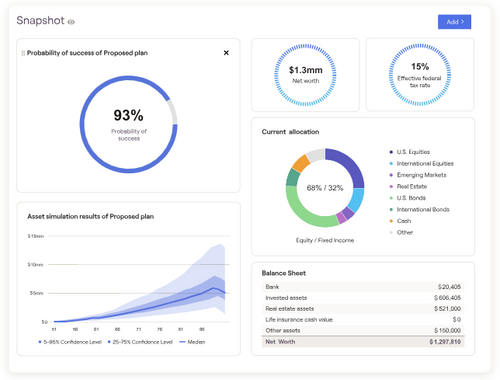

Your Number: The Probability of Success

At the end of our planning process, you get a single number - the probability that your wealth can support the life you want to live. I don't rest until you have an 80% or higher chance of achieving all the goals you're dreaming of.

I use powerful financial planning software that lets us model scenarios in real time: retirement, education savings, new homes, estates, even projected tax returns 30 years into the future. But in the end, the best plan can be presented on a single page.

The Process

Our process is designed to be supportive and empowering. I guide you every step of the way.

Getting to Know You

We start by understanding your values, dreams, and current financial situation. This gives me a clear picture of what truly matters to you.

Setting Your Goals

Together, we define and prioritize your financial goals. Retirement, home purchase, education funding, early independence - we align them with your values.

Crafting Your Plan

I assess your current strategies, identify gaps, and create a personalized plan - your roadmap to the future, addressing any questions along the way.

Putting It Into Action

Once you approve, I implement the plan - executing recommended strategies and making any needed adjustments to your portfolio.

Monitoring & Adjusting

Our work doesn't stop. I regularly review your progress and make adjustments as needed, ensuring your plan evolves with your life.

Ready to get started?

Let's begin with a conversation about your goals and how I can help you achieve them.